Market Overview:

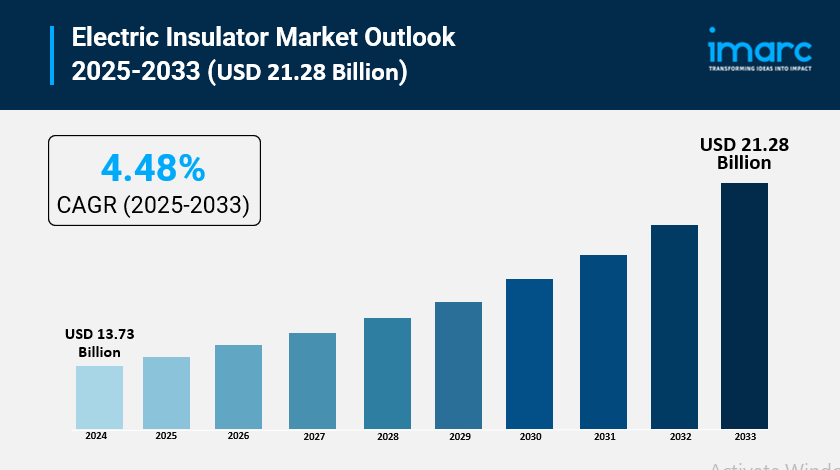

The electric insulator market is experiencing rapid growth, driven by expanding ultra-high-net-worth individual (UHNWI) population, intergenerational wealth transfer and succession planning, and increasing allocation to alternative investments. According to IMARC Group’s latest research publication, “Electric Insulator Market Size, Share, Trends and Forecast by Material, Voltage, Category, Installation, Product, Rating, Application, End Use Industry, and Region, 2025-2033”, The global electric insulator market size was valued at USD 13.73 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.28 Billion by 2033, exhibiting a CAGR of 4.48% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/electric-insulator-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Electric Insulator Market

- Grid Modernization and Infrastructure Upgrades

The need to replace aging transmission and distribution (T&D) infrastructure is a significant market driver, particularly in established economies across North America and Europe. Many existing power grids were built decades ago, and asset failure due to aging equipment is a growing concern. The proactive push for grid modernization mandates the installation of new, advanced insulators that can withstand greater mechanical stress and environmental factors. For instance, in the United States, utility companies are channeling billions into T&D capital expenditures to enhance reliability and resilience. This investment not only involves replacing old porcelain units but also deploying medium-voltage (70-220 kV) insulators, which commanded approximately 40% of the electric insulator market revenue in a recent year, supporting widespread sub-transmission and urban distribution reinforcement projects globally.

- Global Renewable Energy Integration

The accelerating shift toward renewable energy, such as large-scale solar and wind farms, directly fuels demand for high-performance insulators. Integrating variable renewable generation sources requires massive expansion of transmission lines to connect remote generation sites (like deserts or offshore areas) to population centers. Furthermore, these new high-capacity corridors necessitate the use of Extra- and Ultra-High-Voltage (EHV/UHV) insulators—specifically those rated above 765 kV. The UHV segment is charting the briskest growth, reflecting massive projects like the roll-out of ±1,100 kV links in China and new bulk-power corridors in India. These advanced systems demand insulators with specific electrical and mechanical properties, resulting in utilities accounting for an estimated 62% of the total market revenue in a recent period.

- Urbanization and Electrification Initiatives

Rapid urbanization and government-led electrification initiatives, particularly in the Asia-Pacific region, are powerful drivers. The need to deliver reliable power to expanding urban centers and unserved rural areas requires continuous expansion of T&D networks. For instance, in Africa, ambitious government and multilateral agency programs aim to achieve universal electricity access, which requires the build-out of a significant new capacity of generation, millions of new on-grid connections, and a vast network of infrastructure. This expansion involves significant investment in new substations and overhead lines, ensuring that outdoor insulators, which generated approximately 65% of the market revenue in a recent year, remain the dominant product category, propelled by infrastructure development across Southeast Asia and other emerging markets.

Key Trends in the Electric Insulator Market

- The Rise of Composite and Polymer Insulators

A dominant material trend involves the widespread shift from traditional porcelain and glass insulators to composite (polymer) designs. These modern insulators, often made of silicone rubber and fiberglass, offer substantial advantages in terms of weight, contamination resistance, and durability. Their hydrophobic properties significantly reduce leakage current and flashovers, making them ideal for polluted or high-humidity environments. This material segment is experiencing strong growth, with analysts noting its expansion at a significant rate due to utility preferences for lower total lifecycle cost, reduced tower loading, and simplified logistics. Companies like TE Connectivity are continuously developing new polymer-based insulation and arrester products to meet this burgeoning demand for lighter, higher-performing grid components.

- Smart Grid Integration and Sensor Embedment

The adoption of smart grid technologies is transforming insulators from passive components into active data-collection points. The trend involves embedding sensors and Internet of Things (IoT) devices directly into the insulator body or mounting hardware. These systems allow utilities to perform real-time condition monitoring of the grid, tracking critical parameters like temperature, pollution levels, partial discharge, and mechanical load. This real-time data is essential for predictive maintenance, allowing grid operators to preemptively replace faulty units before an outage occurs, thereby improving system reliability and reducing operational costs. This digital transformation supports a fundamental utility shift toward asset hardening and away from only relying on scheduled, calendar-based maintenance.

- Development of Ultra-High Voltage DC (UHVDC) Technology

A pivotal technical trend is the specialized development of insulators for Ultra-High Voltage Direct Current (UHVDC) transmission systems. UHVDC is becoming essential for efficiently transmitting massive blocks of power over long distances with minimal loss, a necessity for connecting remote renewable energy sources. This technology requires insulators that can withstand exceptionally high DC voltages and the unique contamination accumulation patterns they induce. New HVDC-specific designs are entering the market to support these new high-power corridors, creating a segment that is expected to post the fastest growth rate in the application category. This advancement represents a strategic area of focus for global manufacturers like Siemens AG and Toshiba, who are investing heavily in research and development to push the engineering thresholds required for these demanding applications.

Leading Companies Operating in the Global Electric Insulator Industry:

- ABB

- NGK Insulators Ltd

- Aditya Birla Nuvo

- Siemens AG

- General Electric

- Hubbell Incorporated

- Bharat Heavy Electricals Limited

- Toshiba

- Krempel

- MacLean-Fogg

- PFISTERER

- Seves Group

- WT Henley

Electric Insulator Market Report Segmentation:

By Material:

- Ceramic/Porcelain

- Glass

- Composites

- Others

Ceramic/porcelain dominates with 48.1% market share due to excellent electrical and mechanical properties, high dielectric constant, and suitability for high-voltage applications.

By Voltage:

- Low

- Medium

- High

Low voltage leads with 40.6% share, driven by expanding residential, commercial, and industrial electrical installations, urbanization, and rural area electrification.

By Category:

- Bushings

- Other Insulators

Bushings hold 54.2% market share, playing crucial role in electrical systems by providing insulation and support where power lines pass through transformers, walls, or enclosures.

By Installation:

- Distribution Networks

- Transmission Lines

- Substations

- Railways

- Others

Distribution networks lead with 39.8% share as urbanization and population growth increase local electricity demand, carrying power from substations to homes, businesses, and industries.

By Product:

- Pin Insulator

- Suspension Insulator

- Shackle Insulator

- Others

Pin insulator dominates with 45.9% share, used to support power lines on distribution poles and substations, offering durability and efficient electrical insulation for urban and rural energy distribution.

By Rating:

- <11 kV

- 11 kV

- 22 kV

- 33 kV

- 72.5 kV

- 145 kV

- Others

22 kV leads with 15.5% market share, serving applications requiring higher voltage transmission crucial for renewable energy installations and power generation projects.

By Application:

- Transformer

- Cable

- Switchgear

- Busbar

- Surge Protection Device

- Others

Cable application leads with 28.8% share, vital for transmitting electricity underground or underwater, supporting urban infrastructure and connecting power sources across diverse terrains.

By End Use Industry:

- Utilities

- Industries

- Others

Utilities segment drives market expansion as electric utilities generate, transmit, and distribute electricity to residential, commercial, and industrial consumers, requiring high-quality insulators for safe, reliable power flow.

Regional Insights:

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

Asia-Pacific dominates with 37.5% market share in 2024, driven by rapid urbanization, industrialization, and population growth in China, India, and Southeast Asian nations increasing electricity consumption.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302