UAE Confectionery Market Overview

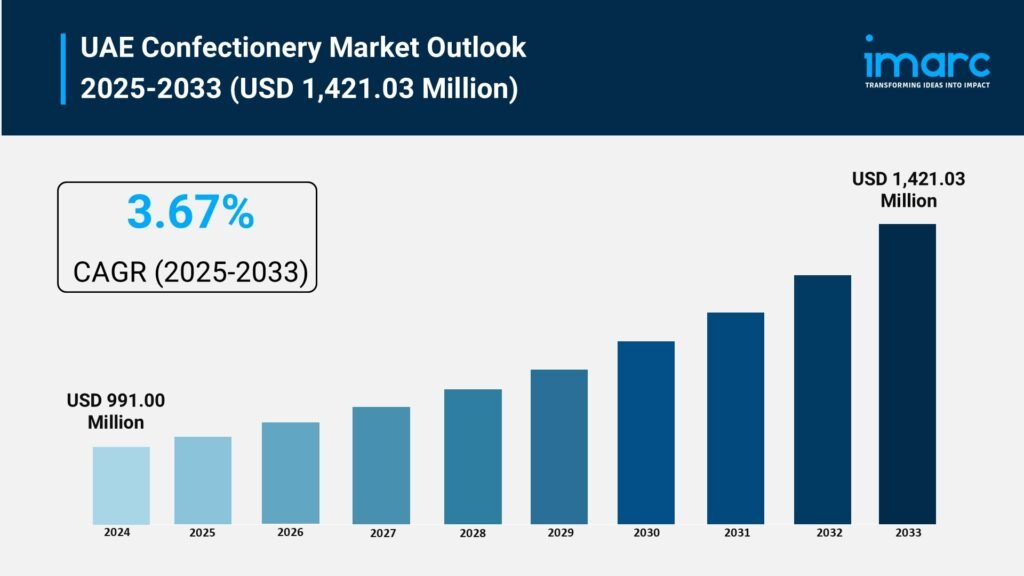

Market Size in 2024: USD 991.00 Million

Market Size in 2033: USD 1,421.03 Million

Market Growth Rate 2025-2033: 3.67%

According to IMARC Group’s latest research publication, “UAE Confectionery Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, The UAE Confectionery market size reached USD 991.00 Million in 2024. The market is projected to reach USD 1,421.03 Million by 2033, exhibiting a growth rate (CAGR) of 3.67% during 2025-2033.

How Premium Innovation and Cultural Fusion Are Reshaping the Future of UAE Confectionery Market

- Premium and Artisanal Products Commanding Market Growth: The UAE confectionery market is undergoing a significant transformation toward premium, gourmet, and handcrafted offerings that cater to increasingly sophisticated consumer tastes. Growing prosperity among UAE residents and a thriving expatriate population are driving demand for luxury confectionery experiences that emphasize quality, authenticity, and distinctive flavors. In October 2024, Dubai’s confectionery landscape saw remarkable innovation with brands leading the premium segment. Al Nassma introduced camel milk chocolate, blending traditional Emirati ingredients with global confectionery expertise. Vivel elevated artistic packaging to new heights, while BRIX partnered with acclaimed chefs to offer dessert tasting menus that transform confectionery into experiential offerings. Bateel promoted gourmet dates positioned as luxury health products, demonstrating how premium confectionery now intersects with wellness and lifestyle aspirations. These developments reflect a clear market shift where consumers seek products emphasizing origin, craftsmanship, sophisticated packaging, and eco-friendly sourcing.

- Health-Conscious Innovation Reshaping Product Development: Health-conscious consumers throughout the UAE are fundamentally reshaping confectionery portfolios, driving manufacturers to innovate beyond traditional sugar-laden products. Low-sugar, sugar-free, organic, and functional confectionery with added vitamins, superfoods, and plant-based ingredients are becoming mainstream offerings rather than niche alternatives. The rising prevalence of lifestyle-related conditions like diabetes and obesity has amplified consumer awareness regarding sugar consumption, creating demand for clean labels and guilt-free indulgences. Younger demographics particularly demonstrate strong preference for nutritional transparency and ethically sourced products, driving brands to highlight wellness credentials without compromising taste or visual appeal. UAE’s national health initiatives and regulatory frameworks promoting nutrition awareness further accelerate this transition. This trend enables confectionery manufacturers to access entirely new consumer segments while simultaneously strengthening brand loyalty among health-conscious demographics seeking balanced indulgence.

- Cultural Fusion Creating Unique Market Differentiation: The UAE’s ethnically diverse population and prominent tourism industry have created a uniquely dynamic environment for confectionery innovation through cultural blending and flavor experimentation. Local ingredients like dates, cardamom, saffron, and rosewater are increasingly combined with Western confectionery formats including chocolate bars, gummies, and premium candies, creating products that resonate across multiple cultural communities. Seasonal and limited-release offerings tied to cultural celebrations—Ramadan, Diwali, Christmas, and Eid—generate consumer excitement and encourage repeat purchases while celebrating the nation’s multicultural character. Social media and influencer partnerships amplify the visual appeal and cultural relevance of these innovative products, driving trend adoption among both local residents and international visitors. This cultural fusion strategy provides confectionery brands with authentic differentiation in an increasingly competitive market, enabling them to build emotional connections with diverse consumer segments through products reflecting their identities and traditions.

- Luxury Retail and Experiential Distribution Expanding Market Reach: The proliferation of luxury retail chains, upscale hospitality venues, and specialty confectionery stores throughout major UAE emirates is reshaping how premium confectionery reaches consumers. Department store confectionery boutiques, hotel gift shops, and standalone gourmet confectionery retailers create curated shopping experiences that justify premium pricing while building brand prestige. Experiential retail environments where consumers can observe production processes, sample limited editions, or participate in confectionery workshops create emotional engagement beyond transactional shopping. These distribution channels particularly appeal to international tourists seeking authentic luxury goods and distinctive souvenirs, while also serving affluent local consumers preferring personalized, high-touch shopping experiences over mass-market retail environments.

- Digital Media and Global Exposure Accelerating Consumer Sophistication: Travel, digital media, and social media platforms are exposing UAE consumers to global confectionery trends, international brands, and niche flavor innovations, driving demand for globally-inspired products and authentic international offerings. Global exposure has elevated consumer expectations regarding flavor complexity, visual presentation, and ingredient quality. Younger consumers particularly leverage social media to discover and share confectionery experiences, creating viral trends around limited-edition products and experiential offerings. This digital-native consumer behavior accelerates product development cycles and encourages confectionery manufacturers to prioritize social media-worthy packaging, storytelling, and flavors that generate consumer engagement and peer recommendation.

Grab a sample PDF of this report:

https://www.imarcgroup.com/uae-confectionery-market/requestsample

UAE Confectionery Market Trends & Drivers:

The UAE confectionery market is experiencing steady expansion driven by rising disposable incomes among residents and the country’s robust tourism industry. Urbanization across major emirates has concentrated affluent consumer populations in metropolitan centers where demand for premium products is most pronounced. Growing middle-class prosperity has increased consumer spending on discretionary items like confectionery, while the substantial expatriate population brings diverse taste preferences and purchasing power to the market. Tourism, particularly from international visitors seeking authentic Emirati experiences and luxury products, creates consistent demand for distinctive confectionery offerings that serve as souvenirs and gifts. This combination of local affluence and international visitor spending provides confectionery manufacturers with multiple revenue streams and justifies investment in premium product development and upscale retail expansion.

Changing dietary patterns and health awareness throughout the UAE are fundamentally reshaping consumer confectionery preferences without reducing overall market demand. Consumers increasingly seek confectionery products aligning with wellness objectives, driving manufacturers to develop innovative formulations that deliver indulgence alongside nutritional benefits. This shift has created new product categories and pricing tiers, enabling manufacturers to capture health-conscious consumers who previously avoided confectionery due to sugar content concerns. Ingredient innovation, clean label development, and functional confectionery formats have transformed what was once perceived as a guilt-laden indulgence into a lifestyle-compatible product category. The convergence of taste satisfaction and health consciousness enables confectionery brands to maintain market relevance while attracting demographics previously underserved by traditional offerings.

The UAE’s diverse cultural landscape and tourism-driven economy are creating unprecedented opportunities for flavor innovation and product differentiation. Local ingredients and cooking techniques blended with international confectionery traditions create products with strong cultural resonance and authentic differentiation. Limited-edition seasonal offerings tied to cultural celebrations generate consumer anticipation and premium pricing opportunities while strengthening brand community engagement. Tourism infrastructure creates consistent demand for distinctive souvenirs and gift-quality confectionery, supporting premium retail channels and experiential distribution models. This cultural dynamism positions UAE confectionery manufacturers as innovators on regional and global stages, enabling them to export culturally-inspired products to international markets while capturing premium pricing from international visitors seeking authentic local experiences.

UAE Confectionery Market Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

- Hard-Boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

Age Group Insights:

- Children

- Adult

- Geriatric

Price Point Insights:

- Economy

- Mid-Range

- Luxury

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

Geographic Breakup:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Confectionery Market

- October 2024: Dubai’s confectionery market witnessed significant innovation and diversification across the premium segment. Al Nassma introduced camel milk chocolate, leveraging traditional Emirati ingredients to create luxury products with authentic cultural connections. Vivel elevated confectionery presentation through artistic packaging innovations, while BRIX collaborated with renowned chefs to develop dessert tasting menus transforming confectionery into experiential culinary events. Bateel positioned gourmet dates as luxury wellness products, demonstrating the market’s evolution toward confectionery that combines indulgence with health consciousness and cultural authenticity.

- Ongoing Innovation: The UAE confectionery market continues witnessing rapid product development across premium, health-conscious, and culturally-inspired segments. Brands are increasingly investing in sustainable sourcing, innovative packaging, and experiential retail environments that justify premium pricing while building consumer loyalty. This dynamic innovation landscape reflects the market’s maturation and the growing sophistication of UAE consumers seeking confectionery products that align with their lifestyle aspirations, health consciousness, and cultural identities.

- Market Expansion Across Retail Channels: Distribution channels for premium confectionery are diversifying beyond traditional supermarkets into specialty stores, luxury retail boutiques, and online platforms. This expansion enables manufacturers to reach affluent consumers through preferred shopping channels while creating experiential retail environments that enhance brand prestige and consumer engagement. The growth of online confectionery retail particularly appeals to younger consumers and busy professionals seeking convenience without sacrificing product quality or exclusivity.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302